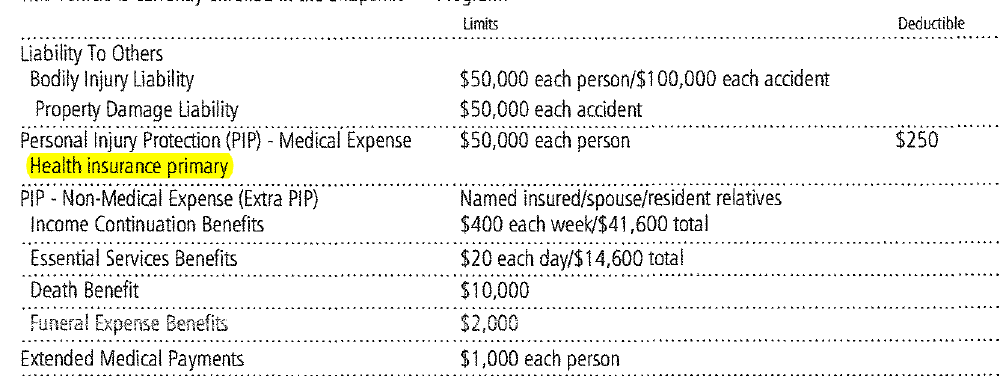

When filling out your New Jersey Auto Insurance policy, please, please, please, do NOT select “Healthcare Primary” or “Health Insurance Primary” as an option on your New Jersey automobile policy. I repeat this mantra daily to my clients (and anyone else in earshot). I’m hoping it sinks in eventually.

Any savings in selecting this option over the automobile No-Fault or PIP (Personal Injury Protection) coverage is so minimal. How minimal, you ask? Well, about $8.00 a year. That’s it. Automobile insurance carriers are notoriously secretive when it comes to the amounts of premiums collected and the amount of claims paid. One major automobile insurance carrier, however, was forced to answer during litigation what their consumers saved by choosing Health Insurance Primary instead of the standard $250,000 in PIP coverage. In their certified statement, they stated the savings to that consumer was $8.00 a year.

There are several negative aspects to having the health insurance carrier control your medical care. Many health insurance plans have large deductibles and co-payments. Many have significant annual limits on common accident-related treatments, such as physical therapy or chiropractic care. Many require a referral, and the family doctor’s office may not be aware of or appreciate the pre-certification requirements involving care for motor vehicle collision patients.

As we’ve stated before, we recommend the selection of the standard $250,000 in PIP / No-Fault Medical Expense coverage. Feel free to take a look at the State’s Automobile Insurance Buyer’s Guide for a description of the different coverage options.

By:

Michael Raff, Esq.